COUSINS PROPERTIES (CUZ)·Q4 2025 Earnings Summary

Cousins Properties Beats on FFO as Sun Belt Office Momentum Continues

February 6, 2026 · by Fintool AI Agent

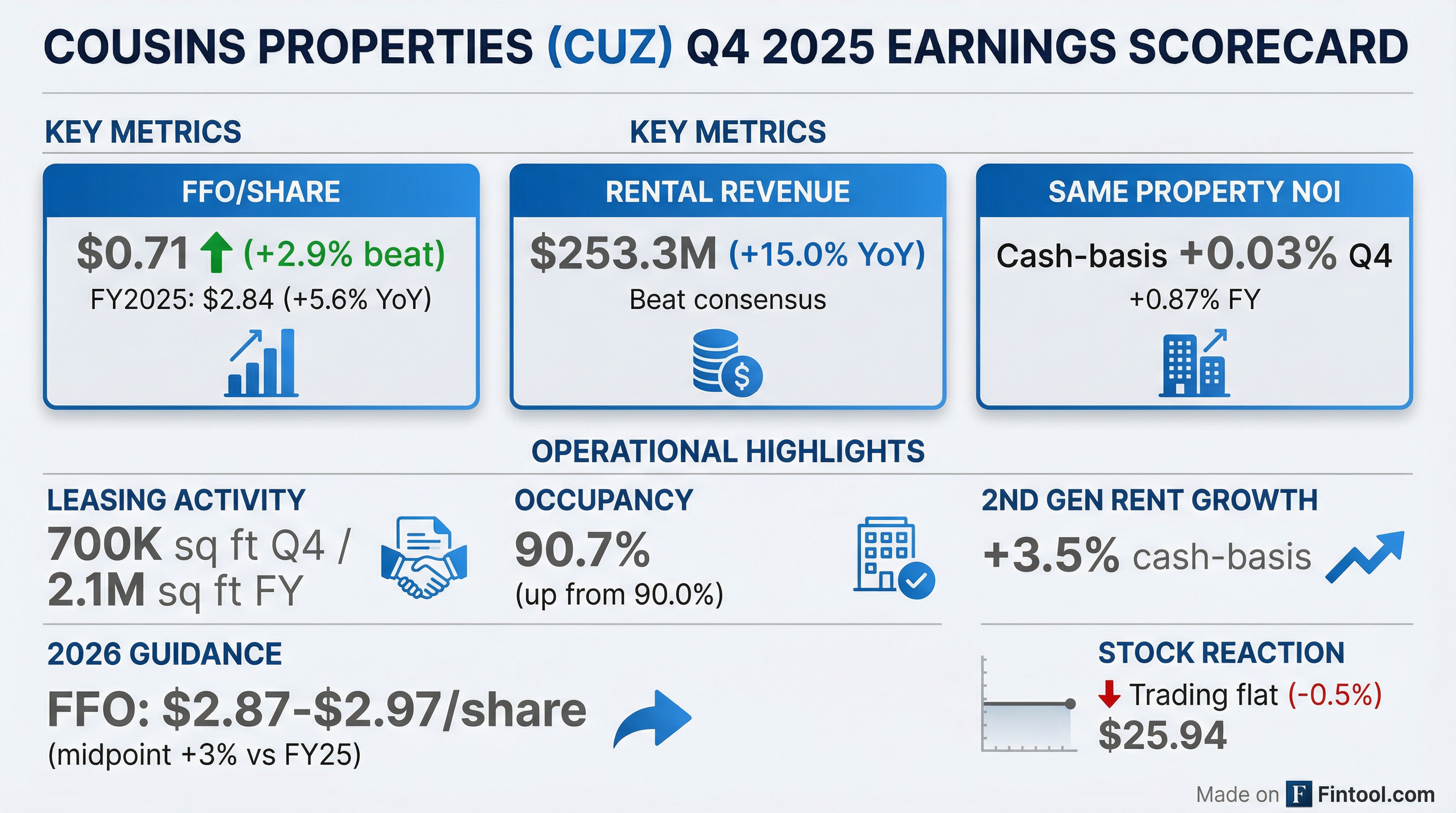

Cousins Properties (NYSE: CUZ) reported Q4 2025 results that beat on both FFO and revenue, with management highlighting improving office fundamentals across its Sun Belt trophy portfolio. The office REIT delivered FFO of $0.71 per share, beating consensus by 2.9%, while executing 700,000 square feet of leases during the quarter.

The company closed on its $317.5 million acquisition of 300 South Tryon in Charlotte on February 2, 2026, capping off $1.4 billion in lifestyle office acquisitions over the past six quarters.

Did Cousins Properties Beat Earnings?

Yes. CUZ beat on both FFO and revenue.

The net loss of $0.02 per share (vs. $0.09 income in Q4 2024) was driven by a $13.3 million operating property impairment charge. Excluding this non-cash item, FFO remained the key performance metric.

Full Year 2025 Performance:

How Did the Stock React?

CUZ stock fell 2.1% to $25.39 following the earnings call, despite the FFO beat. The stock opened at $26.13 but sold off during the day, hitting an intraday low of $25.39. The muted-to-negative reaction suggests investors may be focused on the slower rent spread growth (0.2% in Q4) or the goal-vs-guidance framing around 2026 occupancy targets.

Key Stock Metrics:

The stock is trading near the lower end of its 52-week range, down 19% from the October 2024 high of $31.36.

What Did Management Guide?

CUZ provided initial 2026 guidance that implies continued FFO growth:

Guidance Assumptions:

- Refinancing of $250M term loan (matures Aug 2026), Colorado Tower mortgage (Sep 2026), and 201 N. Tryon mortgage (Oct 2026)

- 300 South Tryon acquisition funded with Harborview Plaza sale ($39.5M), Tremont land sale ($23.7M), and ~$200M additional non-core asset sales

- No speculative acquisitions or development starts included

What Changed From Last Quarter?

Positive Developments:

- Leasing Momentum Accelerating — 700K sq ft leased in Q4 (70% new/expansion), the highest quarterly volume since Q1 2019. Late-stage pipeline of 1.1M sq ft remains near peak levels with 60% new/expansion leasing. Amount of activity in lease negotiations is at its highest level in 5 years.

- Occupancy Improving — Portfolio leased percentage rose to 90.7% from 90.0% in Q3

- Strategic Acquisition Closed — 300 South Tryon ($317.5M, 7.3% cash cap / 8.8% GAAP cap) adds 638K sq ft of 100% leased trophy space in Charlotte with 20% mark-to-market upside on in-place rents

- 47th Consecutive Quarter of Positive Rent Roll-Ups — Second-generation cash rents have increased for 12 consecutive years

Challenges:

- Rent Spreads Compressed — Cash-basis second generation rent growth of just 0.2% in Q4, down from 4.2% in Q3 (excluding Northpark: 10.4%)

- Impairment Charges — $14.3M total impairments (operating property + land) impacted GAAP net income

- Charlotte Vacancy — 550 South dropped to 55.8% leased from 73.2% in Q3

Portfolio Overview: Sun Belt Trophy Strategy

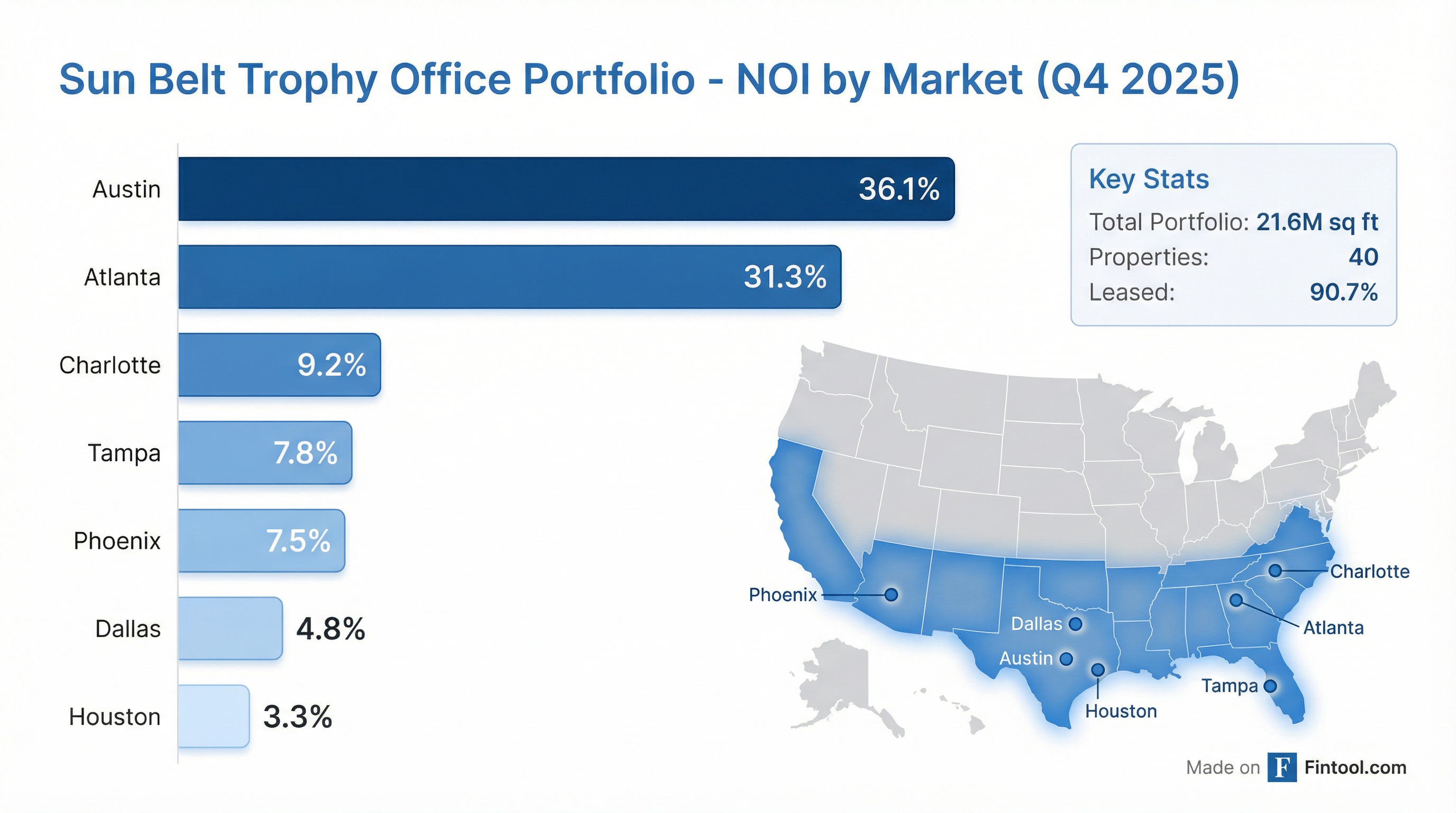

Cousins Properties operates a focused Sun Belt office strategy with 21.6 million square feet across 40 properties. Austin and Atlanta dominate the portfolio, representing two-thirds of NOI. Management sees corporate migration to the Sunbelt reaccelerating, with notable pickup from West Coast and NYC-based companies — particularly financial services relocating to Charlotte and tech companies expanding in Austin.

Q4 2025 Portfolio Statistics:

Top Tenant Concentration

Amazon and Alphabet anchor the portfolio, representing 15% of annualized rent between them:

The top 20 tenants represent 38.6% of annualized rent with a weighted average remaining lease term of 7.1 years, providing solid visibility into future cash flows.

Balance Sheet and Leverage

CUZ maintains a moderate leverage profile with investment-grade credit ratings:

Credit Ratings: BBB (S&P Global, Stable) / Baa2 (Moody's, Stable)

2026 Debt Maturities:

- $250M term loan (Aug 2026)

- Colorado Tower mortgage - $101M (Sep 2026)

- 201 N. Tryon mortgage - $119M (Oct 2026)

Management expects to refinance these maturities, with proceeds from asset sales providing additional flexibility.

Capital Allocation and Dividends

CUZ paid $0.32 per share in quarterly dividends ($1.28 annually), representing a 44.9% FFO payout ratio — below the REIT sector average and providing cushion for reinvestment.

Recent Investment Activity:

Key Management Commentary

"Most major companies are phasing out remote work. Home Depot, here in Atlanta, is the latest Fortune 500 company to end work from home entirely. Thus, office fundamentals are improving."

— Colin Connolly, President & CEO

"We see a notable pickup in leasing interest from West Coast and New York City-based companies, particularly among financial service and select large-cap technology companies... They are significant regional hubs and, in some cases, highlight growth away from high-tax and high-regulation states."

— Colin Connolly, President & CEO

"At some companies, headcount almost doubled [during the pandemic]. Now, as return-to-office mandates have become widespread, many companies lack the space to accommodate their pandemic-era headcount growth even after recent layoffs. Simply said, the tailwinds from accelerating return to office remain greater than the impact of a slower job market."

— Colin Connolly, President & CEO

Q&A Highlights

On Development Strategy: Management is targeting 50% pre-leasing before breaking ground on any new developments, with development yields 150-200 basis points above stabilized cap rates (implying 8.5%-9% yields). Colin Connolly noted Uptown Dallas, The Domain in Austin, and South End Charlotte as the most likely development opportunities.

On Occupancy Goals: CEO framed 90%+ occupancy by year-end 2026 as a "goal, not guidance." With only 4.8% of contractual rent expiring in 2026 and 460,000 sq ft of Q4 leases commencing in 2026 (weighted average in Q3), management sees path to target but cautioned timing of commencements is the primary risk.

On Rent Growth Outlook: When asked about net effective rent trajectory, Connolly cited specific examples: Uptown Dallas rents have "doubled over the last 4 years," and Hayden Ferry in Phoenix saw 10-20% rent growth in the last 12-18 months alone. He noted rent growth in office "rarely moves in a single-digit linear way" and expects landlord-favorable conditions to accelerate.

On Tech Tenant Exposure: Management dismissed concerns about software company downsizing, noting their tech tenant base consists primarily of "very large, well-capitalized technology companies — Amazon and Google being our two largest customers." No tenants have signaled underutilization or negative business impacts.

On Key Expirations:

- Ovintiv (Legacy Union, Plano): Cousins is taking over management and terminating the prime lease mid-2026 to go direct with subtenants. Four subtenant renewals in discussions; only 150-175K sq ft of true vacancy exposure in 2027.

- Samsung (BriarLake, Houston): 123K sq ft expiring November 2026, but only ~70K sq ft is true exposure. Positive discussions underway with subtenants and new prospects.

On 2026 Debt Refinancing: CFO Gregg Adzema indicated refinancing the $465M in 2026 maturities will likely use unsecured debt, with 7-year bonds pricing around 5% and 10-year bonds around 5.35-5.40% at current spreads. CUZ trades at the tightest spread to treasuries among traditional office REITs.

Forward Catalysts

Near-Term (H1 2026):

- Harborview Plaza sale closing ($39.5M) — under contract, expected Q1 2026

- Integration of 300 South Tryon — immediately accretive

- 87K sq ft lease in negotiation at 550 South Charlotte

- Neuhoff Nashville apartments reached 90% occupancy; stabilization expected Q1 2026

Medium-Term:

- Conversion of 1.1M sq ft late-stage pipeline to signed leases

- Potential development start in late 2026/2027 — Dallas, Austin, or Charlotte

- 201 North Tryon lease-up following Bank of America departure — "very encouraging demand" from large users

Longer-Term Thesis: Management believes a shortage of high-quality space will be "particularly acute in 2028, 2029, and 2030" as new construction starts remain at de minimis levels and 20M sq ft per year is being removed from inventory.

The Bottom Line

Cousins Properties delivered solid Q4 results that validated its Sun Belt trophy office strategy. The FFO beat, active acquisition pipeline, and strongest leasing velocity since 2019 suggest the company is well-positioned to benefit from improving office fundamentals. Management's bullish tone on the return-to-office thesis — citing demand acceleration, minimal new supply, and projected space shortages in 2028-2030 — provides a clear narrative for long-term upside.

However, compressed rent spreads (0.2% in Q4), rising leverage, and the "goal vs guidance" framing around occupancy targets warrant attention. The stock's 2% decline following the call suggests investors wanted more conviction.

With CUZ trading near 52-week lows and offering a ~5% dividend yield, the stock offers a value-oriented play on office recovery — but investors should monitor same-property NOI growth, rent spread trajectory, and late-stage pipeline conversion as leading indicators.

Data sources: Cousins Properties Q4 2025 8-K filing, Q4 2025 earnings call transcript (February 6, 2026), S&P Global estimates.